Tool #1: Business Continuation

Business Continuation can be used to:

Properly valuate the business

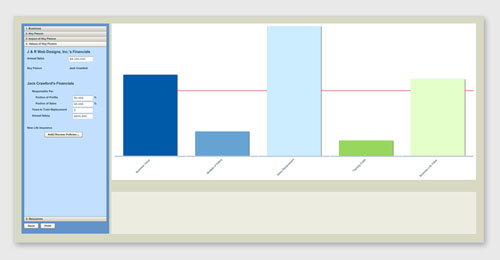

Perform calculations for five different valuation methods accepted by the IRS. Present the results in both an interactive screen graph and a complete printed summary presentation.

Explore various owner needs

Explore solutions based on the relationship between the owner, the form of business, and the owner's continuation preferences.

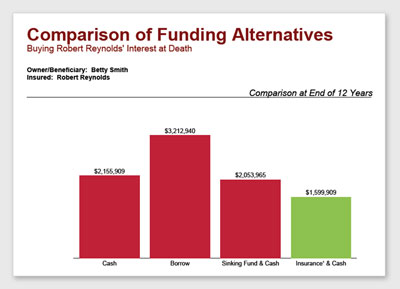

Explore different funding needs

Consider potential solutions and determine the funding requirement for the solution amount.

Click image to enlarge

Business planning sales involve these four steps:

- Convincing clients that they need to consider continuing their business

- Determining the fair value of the business

- Agreeing to a solution and adopting a business continuation plan

- Determining how to fund the solution

With Business Continuation you can complete any one of these steps without completing the others. For example, you may establish a client's need, determine the fair market value of the business, and implement legal documents for a plan without determining how to fund the solution.

No other product provides this level of power and flexibility.

Same Great Features

- On screen resources help explain complex or difficult concepts.

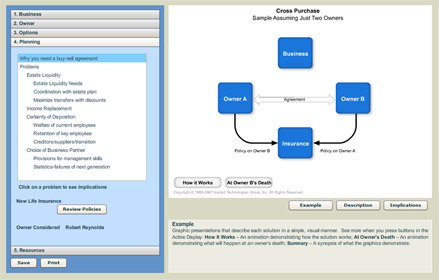

- Insurance calculations for cross purchase agreements.

- Business Valuation is now built-in Business Continuation, one completely integrated tool.

Enhanced Look

- Data entry is now streamlined to make navigation easier.

- Updated graphics for both on-screen and printed presentations.

New Features

- Maximum number of business owners increased from 7 to 15.

- Insurance needs are calculated using future value of the business.

Click image to enlarge

Tool #2: Key Person

Show the Dual Role of Life Insurance

Key Person helps a business owner establish the value and impact a key person has on the company. When that key person happens to be an owner, life

insurance could provide a solution not only to the business continuation plan, but also the key person planning as well.

For Business Owners or Non-Owners

Use Key Person to evaluate the same owners that were used in the Business Continuation analysis. Or use Business Continuation on the owners, and then use Key Person independently of

Business Continuation to evaluate non-owner key employees.

Properly Value the Business

Use the built-in Business Valuation tool to perform calculations for five different valuation methods accepted by the IRS. Present the results in both an interactive screen graph and a complete printed summary presentation.

Or, simply type in a business value provided by the owner. Either way, you will need to establish a business

value so you can assign a dollar value to the impact the key person has on the business value.

Two Unique Features of Key Person

Rate the Impact of a Key Person

- Rate key person’s value on a scale of 1 to 10.

- Evaluate key person’s value in different areas of company (impact on sales, relationships with employees, unique skills/knowledge, etc.).

- Include expectations of key person’s family and how ownership would be transitioned.

Click image to enlarge

Translate Impact into Value

- Calculation of 5 different key person valuation methods.

- Chart helps determine which method(s) are most accurate.

- Software calculates several alternatives based on multiple valuation methods.

- Client ultimately determines the key person’s value.

Click image to enlarge

Tool #3: Business Valuation

The biggest problem with valuing a business interest is that there is no exact method for determining a value that will work in all situations; all professionals in the field will agree upon that. In fact, if you asked five different professionals to value the same business interest, chances are good that you would get five different results!

Click image to enlarge

Even the Internal Revenue Service has recognized that no single valuation method is adequate for obtaining an accurate valuation of a business! Therefore, it is common for several methods to be used so that a reasonable range of values can be obtained.

This program will help you and your clients prepare business valuations that are more likely to be accepted by the IRS.

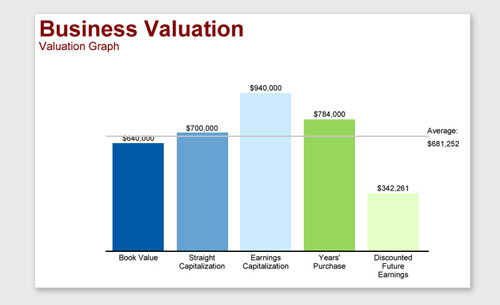

Business Valuation performs calculations for 5 different valuation methods, and presents the results in both an interactive screen graph and a complete printed summary presentation. The five methods used by Business Valuation are:

- Book Value

- Straight Capitalization

- Capitalization of Earnings

- Years' Purchase

- Discounted Future Earnings

You even get the average of the results of these five different methods and a comparison of these five methods. (This is all you will need to support your calculations for the client's legal and tax advisors.)

See how any calculated number is derived and how each segment of any interactive bar graph is calculated!

Click image to enlarge

Are You in the Family Limited Partnership Market?

Business Valuation gives you the ability to discount for lack of marketability or lack of control. This makes the product especially useful for family limited partnerships.

Subscribe Now

Requirements:

- Internet Explorer 7 or greater,

Firefox 3 or greater

- Adobe Reader 7.0 or greater

- Connection to the internet

PlanLab®

This product sits on the Web-based PlanLab platform. The complete functionality of PlanLab comes in an easy-to-use, web-based package that requires little

or no training to get started. Intuitive features in PlanLab make it easy to collect and analyze client data, motivate clients to action, and monitor their progress.

Impact Technologies Group, Inc. (Impact®)

Impact is known throughout the industry for creating sales presentations that combine numerical analysis and sales psychology to inform, alarm, and motivate

clients to take action.