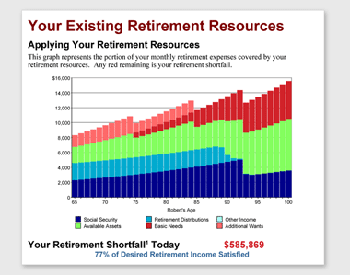

A Sales System that Helps Advisors Chart Retirement Courses for Baby Boomers

An innovative sales system that offers financial advisors a complete planning solution for the baby boomer marketplace. The product focuses specifically on retirement distribution planning by helping advisors develop a sound financial plan based upon assets and income their clients will have through their retirement years.

- Analyzes a client's needs, income and assets

- Assists advisors in determining appropriate policies, annuities and other planning options

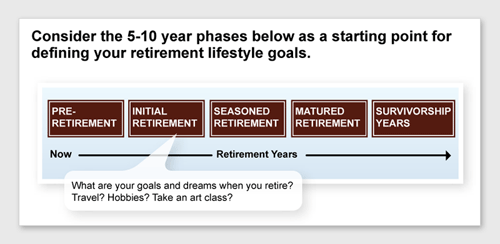

- Also includes a detailed consumer brochure showing how concerns shift during retirement

Click image to enlarge

Impact's Retirement Road Map is designed to help baby boomers answer questions such as, 'Do I have enough money to retire? Will I run out of money? How do I map out a retirement strategy? How will I know if I am staying on track? It is one of the first products available that helps advisors focus on the boomer marketplace and distribution planning, which is growing at an astonishing rate.

Calculating retirement resources is particularly challenging, as some information is provided as monthly income at retirement, and other information is in terms of investment or asset values today. Retirement Road Map calculates known retirement incomes, social security, pensions, annuities, etc., compares that to the retirement needs, and then calculates the value today necessary to make up the difference. As a result, there is a single number to compare to assets or investments. Impact makes complex calculations easy to understand so clients can make important decisions. Retirement Road Map shows a strategy for each year of retirement to assure predictable income while maximizing investments.

Click image to enlarge

Needs and wants for each phase are defined in today’s dollars and compared to known sources of retirement income to determine how much will be required for

the remaining needs. The amounts needed and their respective time horizons provide both a retirement distribution plan, as well as an allocation of retirement

assets. Risk goes hand-in-hand with time horizons—the sooner the money is needed, the less risk the client should take.

Click image to enlarge

- Annuities to provide secured, lifetime income guarantees

- Life Insurance to provide the remaining funds needed for the survivorship period

- Long-Term Care, Critical Illness, Cancer, and Accident policies to guard against some of the uncertainties in retirement

- Investments to re-allocate assets being used as retirement funds

- Estate Planning to provide for remaining assets at death

- Comprehensive Planning initiated to answer all of the clients financial questions

Impact's Retirement Road Map has three integrated sections:

- Brochure – Explains steps for retirement distribution planning. (Also available in a friendly client brochure to use for prospecting.)

- Current analysis – Compares needs, known income, and retirement assets. It is produced from a quick, electronic fact finder or the answers to the Six Questions in the brochure.

- Recommendations – Helps the advisor determine the appropriate recommendations—including specific policies and annuities and other planning opportunities.

Retirement Road Map is an add-on application to Impact's web-based financial sales and collaboration platform, PlanLab ®. PlanLab automates the financial sales process across an enterprise, from initial fact finding to financial plan generation, enabling financial advisors to work more efficiently with clients and close more sales. With PlanLab, advisors can assist clients in defining financial goals, collect and analyze relevant information and model planning scenarios as well as generate customized proposals.

Subscribe Now

Requirements:

- Internet Explorer 7 or greater,

Firefox 3 or greater

- Adobe Reader 7.0 or greater

- Connection to the internet

PlanLab®

This product sits on the Web-based PlanLab platform. The complete functionality of PlanLab comes in an easy-to-use, web-based package that requires little

or no training to get started. Intuitive features in PlanLab make it easy to collect and analyze client data, motivate clients to action, and monitor their progress.

Impact Technologies Group, Inc. (Impact®)

Impact is known throughout the industry for creating sales presentations that combine numerical analysis and sales psychology to inform, alarm, and motivate

clients to take action.